is there real estate transfer tax in florida

Documents that transfer an interest in Florida real property such as deeds. This tax is normally paid at closing to the Clerk of.

:max_bytes(150000):strip_icc()/Enhanced-Life-Estate-Deed-56aa10bb3df78cf772ac382f.jpg)

How To Use A Transfer On Death Deed To Avoid Probate

This tax is normally paid at closing to the Clerk of.

. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. Typically the real estate agent obtains a check for the amount from the seller. Miami-Dades tax rate is 60 cents.

The average property tax rate in Florida is 083. The Florida documentary stamp tax is a real estate transfer tax. There is no specific exemption for documents that transfer Florida real property for estate planning.

The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000. The state of Florida commonly refers to transfer tax as documentary stamp tax. Real Estate Transfer Tax Florida imposes a transfer tax on the transfer of real property in Florida.

There is currently no Boston. Its customary for the seller of the property to pay for this tax in Florida. The state of Florida commonly refers to transfer tax as documentary stamp tax.

PDF 125 KB. For the purposes of determining. Property Tax Exemptions and Additional Benefits.

The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. The Director Real Estate Transfer Tax will play an instrumental role in the development of the Real Estate Transfer Tax section of the Property Tax Consulting Practice. The Massachusetts real estate transfer excise tax is currently 258 per 500 value transferred which is a 0456 tax rate.

There are also special tax districts such as schools and water management districts that. Further for all other types of transfers in Miami-Dade County there. If passed this new transfer tax would be 20 for amounts over 2.

Call The Law Office Of Richard S. Florida Real Estate Transfer Taxes - LegalClose. Florida does not have an inheritance tax so Floridas inheritance tax rate is.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Does Florida have real estate transfer tax. The tax is called documentary stamp tax and is an excise tax on the deed.

In Florida transfer tax is called a documentary. Further for all other types of transfers in Miami-Dade County there is an additional tax of 45 per 1000 that is due to the payment of. Does Florida have real estate transfer tax.

Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every. Since there is no other consideration for the transfer.

Massachusetts MA Transfer Tax. Sales and Use Tax. Each county sets its own tax rate.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person.

Real Estate Transfer Taxes Deeds Com

Transfer Tax Calculator 2022 For All 50 States

Real Estate Transfer Tax What Are They Where Does The Money Go

Transfer Taxes In Miami Dade Vs Other Counties Florida Independent

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

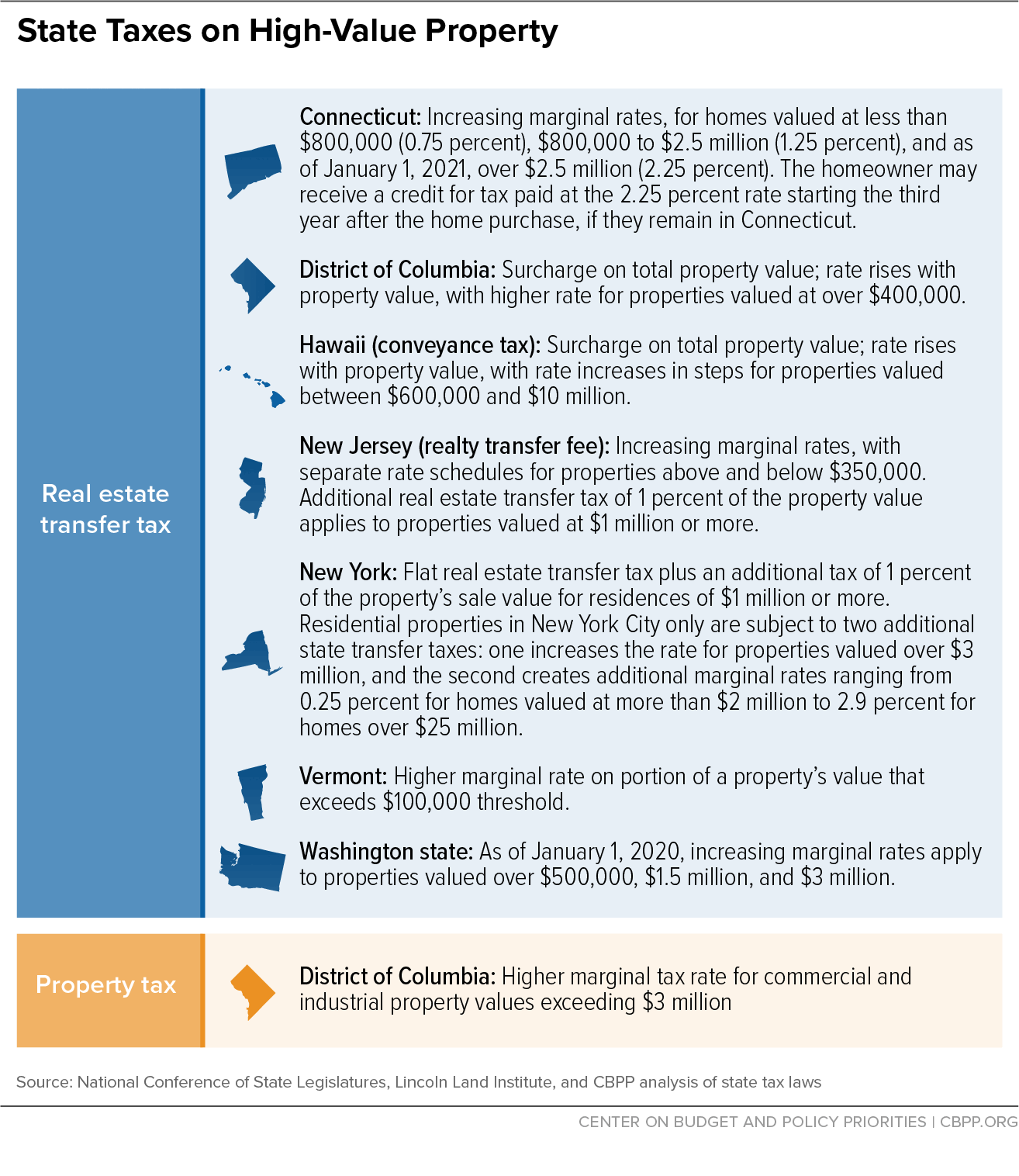

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Sales Taxes In The United States Wikipedia

Real Property Transfer Taxes In Florida Asr Law Firm

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Real Estate Transfer Taxes Deeds Com

Florida Real Estate How Much Will It Cost Nmb Florida Realty

Florida Real Estate Transfer Taxes An In Depth Guide

Property Transfer Information Form Pdf Fpdf Docx Florida

Real Property Transfer Taxes In Florida Asr Law Firm

What Is A Transfer Tax When The Tax Man Crashes Your Home Sale Valuepenguin

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities